what is a secondary property tax levy

Secondary Property Tax Levy debt repayment. The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located.

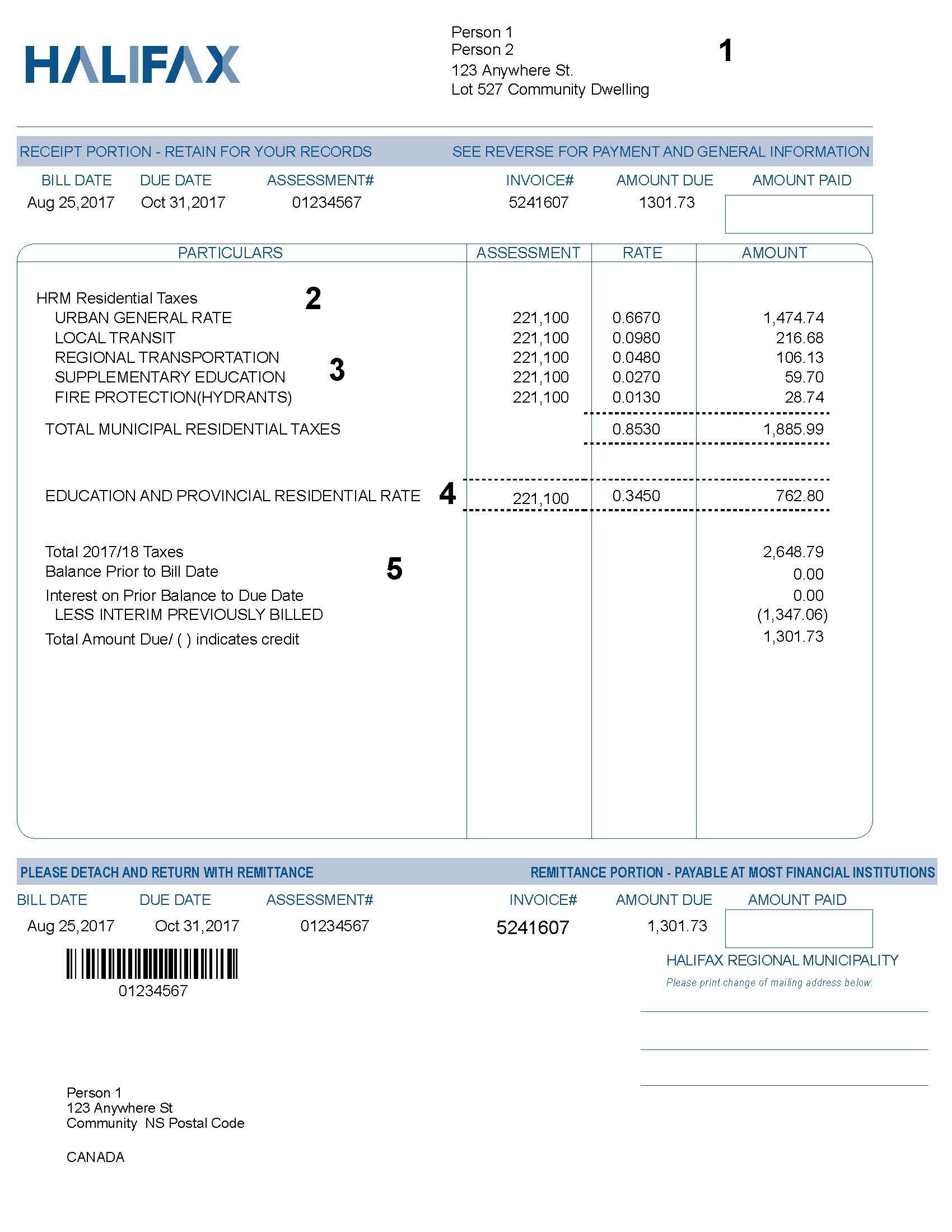

How To Read Your Tax Bill Property Taxes Taxes Halifax

The total rate of 21196 is 001 lower than the total 2020-21 rate of 21296.

.jpg)

. LEVY LIMITS HOMEOWNERS REBATE TAX DEFERRAL EXEMPTIONS. For example the annual growth in secondary taxes levied by fire districts is limited to 8 but are subject to a 325 statutory tax rate cap. Levies are different from liens.

Governments enforce a property tax levy as a measure of last resort. South Carolina is ranked 45th of the 50 states for property taxes as a percentage of median income. Secondary Property Tax Levy GO Debt Repayment.

Refer to number 4. Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. In other words the levy is the cap on the amount of property.

A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. Secondary property tax levy The levy is a 173 million increase from fiscal year 2020-21s 2415 million levy. 14 Special District Tax.

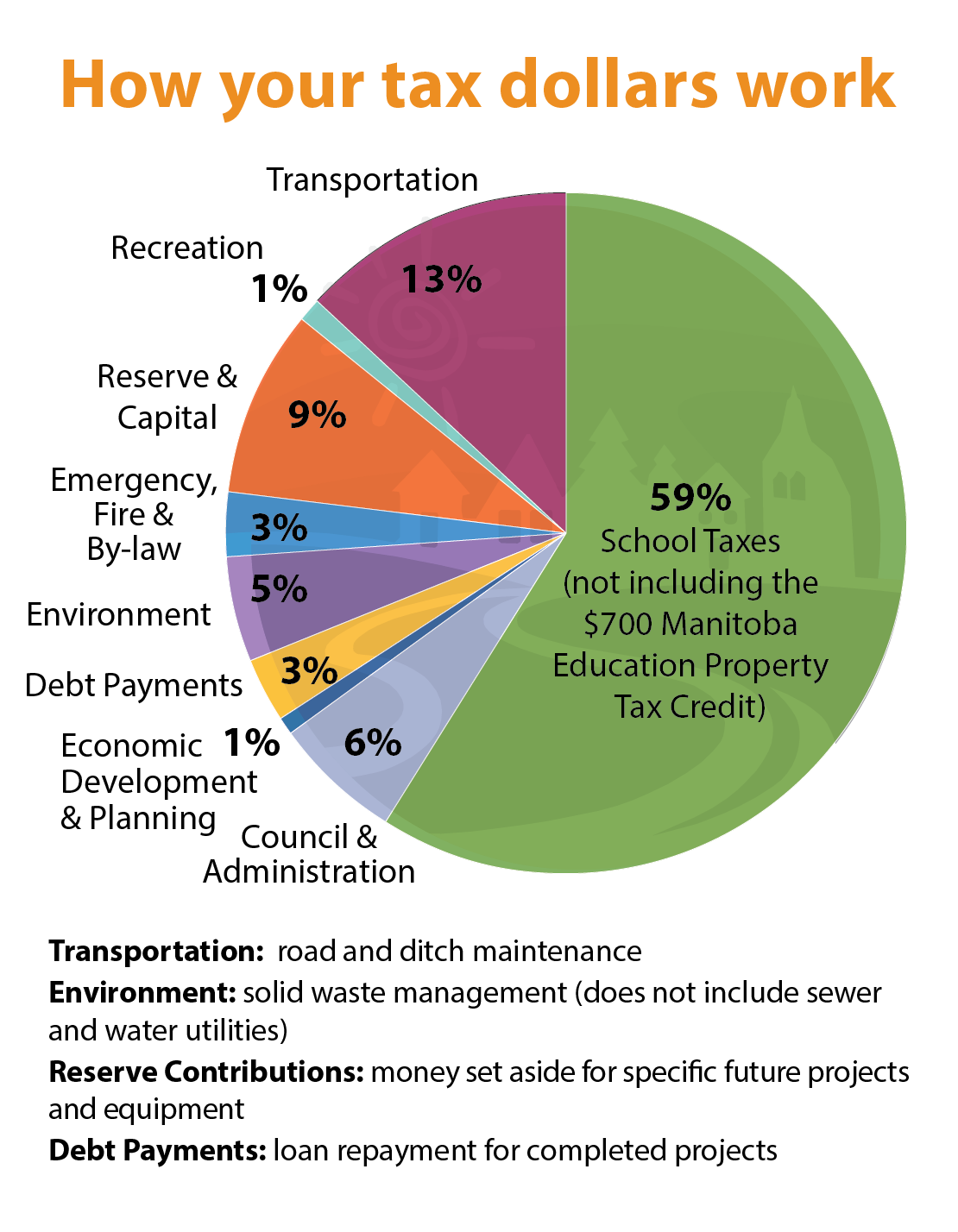

CITIES AND TOWNS TAX LEVIES SECONDARY ROLL FISCAL YEAR 2020-21 SCHEDULE C Page. The levy is not the amount of money that individual homeowners pay. Property taxes are one of the primary if not the only ways for municipalities to raise revenue for community services.

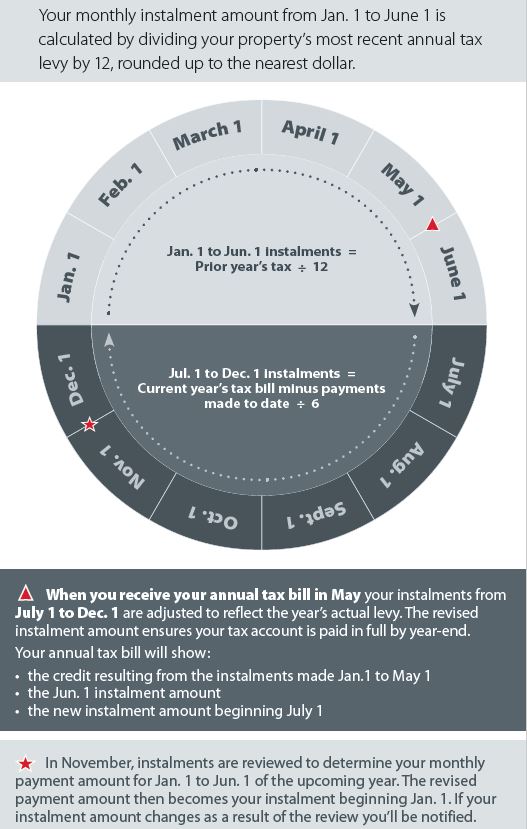

The City uses the tax levy not the tax rate to manage the secondary property tax. Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. Failure to pay your property taxes can result in fines penalties interest and even the seizure of your property.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. The levy is divided out among all the homes and businesses in Gilbert. The value of each property in the City is determined annually by either Maricopa County or the State.

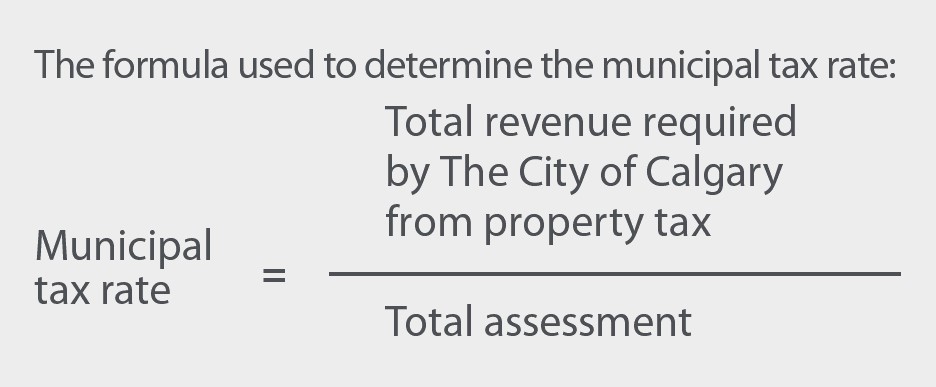

A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation. The tax levy is calculated using the formula to the right.

The act of imposing a tax on someone is called a levy. What is an assessed value. A tax rate is the percentage used to determine how much a property taxpayer will pay per one hundred dollars of net assessed value.

15510 15510 15186 15186. Estimated secondary property tax levy of 120493943 used only for debt service equating to a rate of 08141 per 100 of assessed valuation. Towns and cities use the proceeds from levying property taxes to fund the.

2016 Arizona Property Taxes Explained 4 The myriad of special taxing districts that levy secondary property taxes are subject to different statutory tax limits. The secondary property tax rate residents pay has stayed the same for the past few years. 2020 2020 2020 PROPERTY TAX.

ConcurrencePrevious Council Action The proposed 2021-22 property tax levy reflects actions taken by the Council on the. A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt. 2 SECONDARY TAX RATES are used to fund such things as bond issues budget overrides and special district funding.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. The secondary tax is. 07510 7510 07186 7545.

A levy is a legal seizure of your property to satisfy a tax debt. A tax rate is figured by dividing the total secondary property tax levy by the total assessed value in town to determine each property owners share of the levy. 301 West Jefferson Street Phoenix Arizona 85003 Main Line.

A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt. Beaufort County collects the highest property tax in South Carolina levying an average of 045 of median home value yearly in property taxes while Chesterfield County has the. The idea of a levy is that the government will take the property because you are unable.

A property tax levy is the right to seize an asset as a substitute for non-payment. As Gilbert grows we get more residents and businesses to help pay for projects. Operating Levy 640280922 45704969813 14009.

2020 TAX LEVY TABLE OF CONTENTS Note. Therefore not paying your property taxes can result in the government seizing your property as payment. What is the difference between a tax rate and a tax levy.

Since 2006 the amount of the secondary property tax levy has ranged from 008 cents to 019 cents per 100 of assessed value and the total amount collected has gone from 40 million to this year. The calculation of secondary tax is similar to primary tax but instead is based on the total full cash value To tal FCV of the assessed property as opposed to the limited value. The Arizona Constitution limits the total amount of primary property taxes that counties cities and community college districts can levy.

The exact property tax levied depends on the county in South Carolina the property is located in. The levy limits of fire districts. Secondary Property Tax SEC.

As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year. Another tax that is levied on property owners is a property tax which is. Where does Internal Revenue Service IRS authority to levy originate.

In determining and levying primary and secondary property taxes on all property. Change 324 City Taxing Authority. The Internal Revenue Service IRS can impose levies on taxpayers to satisfy outstanding tax debts.

Secondary Property Tax Rates.

Property Tax Info Rural Municipality Of St Clements

Nse Turnover Drops By 30pc In Second Quarter Capital Market Investing Investors

Saskatchewan Property Tax Rates Calculator Wowa Ca

Statistics Canada Property Taxes

City Of Cranbrook Average 21 Increase In Residential Assessments Doesn T Translate Into A 21 Property Tax Increase For Local Homeowners

Buying A Property In British Columbia Know Your Tax Costs Smythe Llp Chartered Professional Accountants

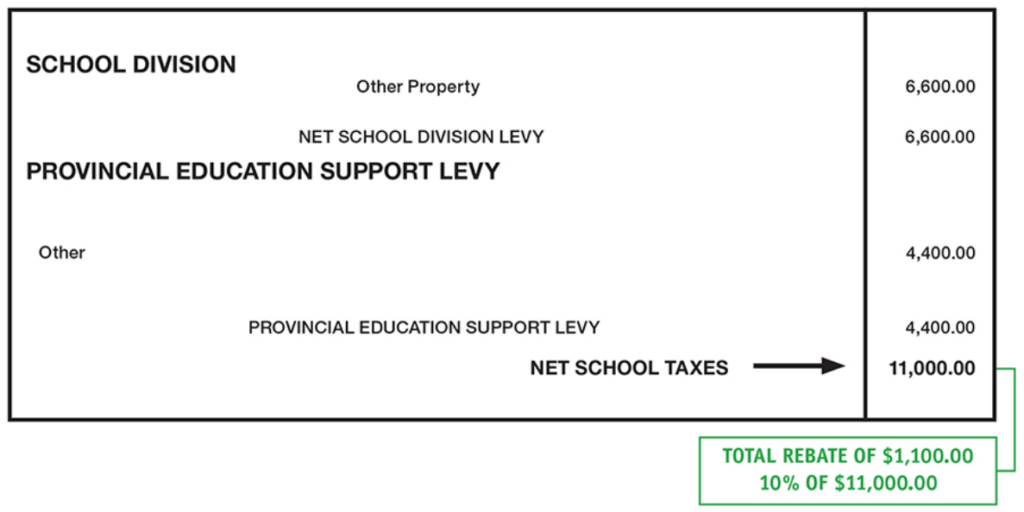

2021 Property Tax Bill Guide Rural Municipality Of St Clements

Pin On Economic Perceptions Of China

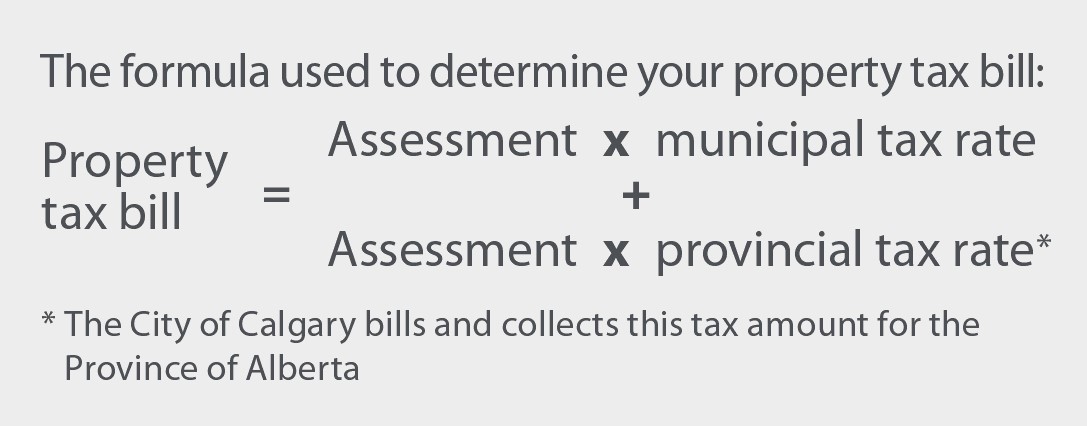

Property Tax Tax Rate And Bill Calculation

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Statistics Canada Property Taxes

Statistics Canada Property Taxes

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Property Tax Tax Rate And Bill Calculation

Around 40 Property Owners In Bengaluru Don T Pay Tax The Economic Times Paying Taxes Economic Times Bengaluru