salt tax deduction calculator

Ad Compare 2022s Most Recommended Tax Relief Companies that Can Help You Save Money. Free Federal Filing for Everyone.

Now That Tax Change Is More Real What Should You Do Chase Com

Ad Enter Your Tax Information.

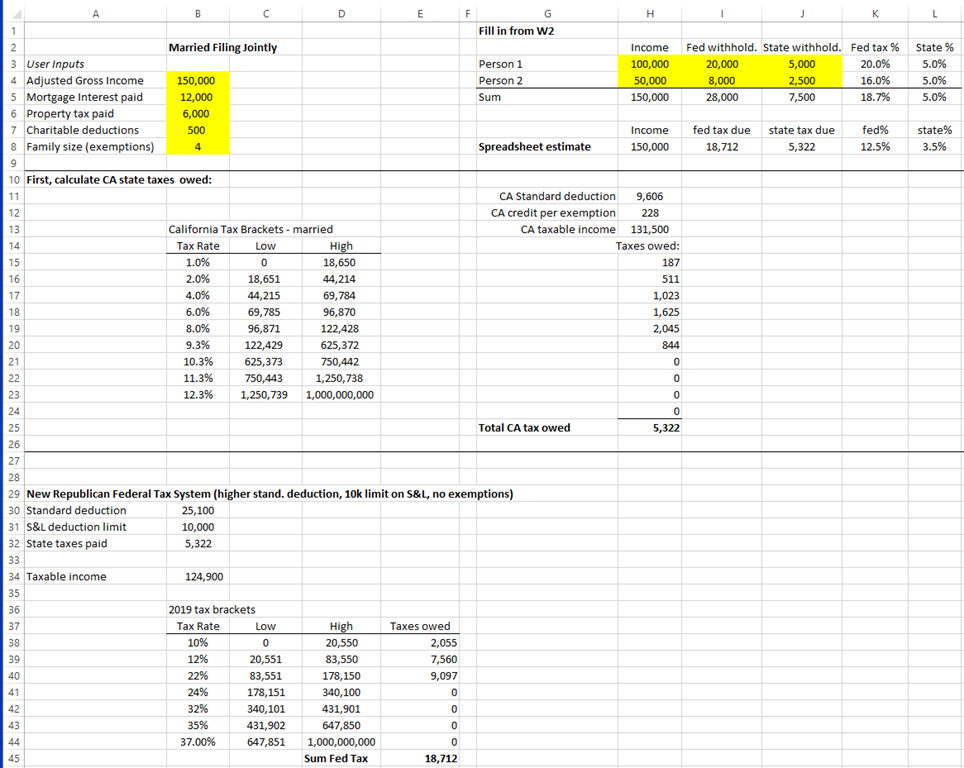

. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000. If your total is 10000 or less write the full amount on line 5e.

List your state and local personal property taxes on line 5c. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Before the creation of a cap on this deduction 91 of the benefit. New limits for SALT tax write off. Using Schedule A is commonly referred to as itemizing deductions.

The lawmakers mainly from the Northeast states say they are disappointed that the bill does not heed their calls to restore the State and Local Tax SALT deduction. See How Much You Can Save With Our Free Tax Calculator. The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000.

The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax. Explore Our Recommendations for 2022s Top Tax Relief Companies. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Get a Free Consultation. The federal tax reform law passed on Dec. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Add up lines 5a 5b and 5c. See What Credits and Deductions Apply to You.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize.

How to take advantage of the new legislation. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

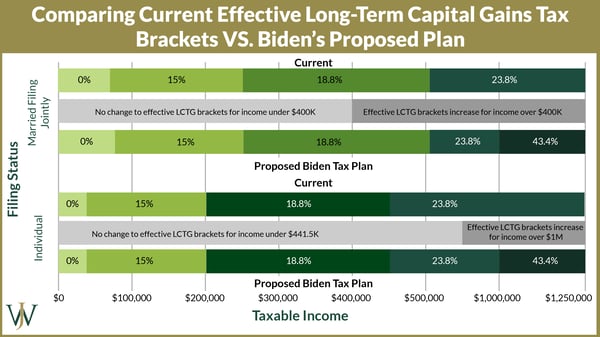

A Democratic proposal aims to restore the SALT deduction for taxpayers who make. The SALT deduction applies to property sales or income taxes already paid to state and local governments. Income taxes or sales taxes.

This created an enormous opportunity for everyday business owners to maximize their SALT deduction. Sales Tax Deduction Calculator. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. 52 rows The SALT deduction is only available if you itemize your deductions.

If your total is more than. The Tax Cuts and Jobs Act. This significantly increases the boundary that put a cap on the SALT.

Discover Helpful Information And Resources On Taxes From AARP. If you paid 5000.

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Tax Day Freebies List 2012 Free Panda Express More

Mileage Log Template For Taxes

Mileage Log Template For Taxes

Taxes Archives Spreadsheetsolving

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

Georgia S Pass Through Entity Tax Election Offers Salt Cap Workaround Mauldin Jenkins

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

If You Are Running A Company Or If You Are Working As An Accounting You Will Be Familiar With The Meaning Of Cost Of Goods Sold Cost Of Goods Excel Templates

Accountants In Romford Are Equipped With Technology And Skills Bookkeeping Services Accounting Services Accounting Companies

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Pin En Bankruptcy Lawyer Ogden Utah

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Tax Day Freebies List 2012 Free Panda Express More Tax Write Offs Tax Deductions Tax Time

Does Your State Have An Individual Alternative Minimum Tax Amt

How To Survive A Tax Audit As A Contractor When You Cheated